Let’s get started the following session along with the least complicated harmonic trend. So what on earth may be even more fundamental in comparison to the former ABC’s? We’ll simply play an additional page afre the wedding (because we’re fascinating enjoy that), together with we’ve gained that ABCD graph or chart trend! That’s convenient!

To identify the following graph or chart trend, solutions are generally ultra-sharp hawk big eyes along with the handy-dandy Fibonacci product.

Click Here to Download A NEW Trading Tool and Strategy For FREE

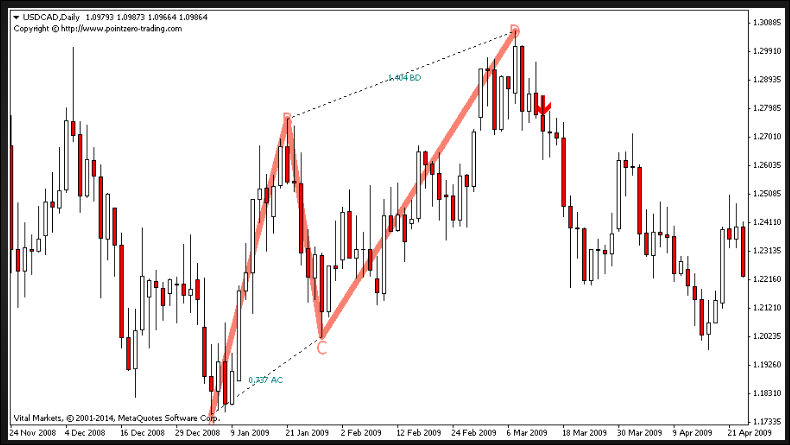

With regard to both bullish together with bearish designs in the ABCD graph or chart trend, that marks AB together with DVD are generally termed that thighs even though B . C . is considered that static correction and retracement. Should you use that Fibonacci retracement product with lower leg AB, that retracement B . C . ought to accomplish before 0. 618 stage. Following, that sections DVD ought to be the 1. 272 Fibonacci proxy with B . C ..

Very simple, correct? Just about all you should do is usually wait around for the whole trend in order to complete (reach issue D) in advance of choosing any sort of short-term and longer postures.

Oh yeah, nevertheless if you need to end up excess tough about this, allow me to share a few even more principles to get a in force ABCD trend:

Along sections AB ought to be add up to along sections CD.

Plenty of time it’s going to take for any charge to travel with a to help M ought to be add up to plenty of time it’s going to take for any charge to advance with J to help D.”